What is the purpose of a bank account?

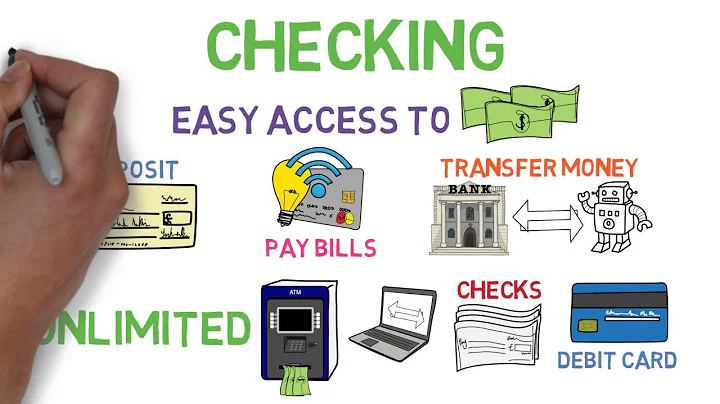

Opening a bank account can be one of the most important steps you take toward reaching your financial goals. Why? Because putting your money in an FDIC-insured bank account can offer you financial safety, easy access to your funds, savings from check-cashing fees, and overall financial peace of mind.

A bank account serves features like, It makes cash deposition and withdrawal easy, for some accounts also provides interest on total sum of money in the account like in savings account, provides detailed transactions summary and also acts as a locker where our money is safe.

Your money will be protected from theft and fires. Plus, your money will be federally insured so if your bank or credit union closes, you will get your money back. The maximum amount of money that can be insured is $100,000. Many banks offer an interest rate when you put your money in a savings account.

A basic bank account works like any bank or current account, so you can: receive payments, like wages, benefits and pension. pay for things or take out cash with a debit card.

With a bank account, you can store your money securely and access it when you need it, making it a safer option as well as a convenient one.

The Short Answer: Yes. Share: The IRS probably already knows about many of your financial accounts, and the IRS can get information on how much is there. But, in reality, the IRS rarely digs deeper into your bank and financial accounts unless you're being audited or the IRS is collecting back taxes from you.

How Much Money Do I Need To Open A Bank Account? Some banks do not require a minimum deposit, while others require between $25 - $100 once approved. If you need to make an initial deposit, there are a few options: Write a check for the amount.

Although it's possible to function in society today with no bank account, it's not recommended. That's because, without a bank account, the cash and funds you keep are less safe and it's more difficult to use, transfer, and manage your money.

Meanwhile, the top-cited reason among all unbanked households for having no bank account is not having enough money to meet minimum balance requirements. The percent of unbanked households varies significantly by income level and race/ethnicity.

There are several ways that scammers can gain access to your online bank account. They could use phishing attacks, malware or other cyberattacks, or buy your credentials online after a data breach.

Can anyone do anything with your bank account?

If someone gains access to your bank account and routing numbers, they can use the information to fraudulently withdraw or transfer money from your account. They can also create fake checks, claim your tax return or commit other forms of financial fraud.

How much is too much cash in savings? An amount exceeding $250,000 could be considered too much cash to have in a savings account. That's because $250,000 is the limit for standard deposit insurance coverage per depositor, per FDIC-insured bank, per ownership category.

Unless your bank requires a minimum balance, you don't need to worry about certain thresholds. On the other hand, if you are prone to overdraft fees, then add a little cushion for yourself. Even with a cushion, Cole recommends keeping no more than two months of living expenses in your checking account.

For financial security, keep some cash in the bank. Double emphasis on some, because there are good reasons not to keep too much money in cash, too. Inflation decreases the value of any money you hold in cash. Inflation, aka rising prices over time, reduces your purchasing power.

While it is legal to keep as much as money as you want at home, the standard limit for cash that is covered under a standard home insurance policy is $200, according to the American Property Casualty Insurance Association.

The IRS has broad legal authority to examine your bank accounts and financial records if needed for tax purposes. Some of the main laws that grant this power include: Internal Revenue Code Section 7602 – Gives the IRS right to examine any books, records or data related to determining tax liability.

At the moment of deposit, the funds become the property of the depository bank. Thus, as a depositor, you are in essence a creditor of the bank. Once the bank accepts your deposit, it agrees to refund the same amount, or any part thereof, on demand.

There aren't any direct downsides to opening a bank account without a deposit. However, if you open a savings account without a deposit (versus a checking account), you won't start earning interest right away.

If you do, opening an account at a bank or credit union is straightforward. The interest they pay for savings accounts You usually need to make an initial deposit between $25 and $100 to open a savings or checking account. Find out how much you must keep in the account at all times to avoid or reduce fees.

Generally, an account is considered abandoned or unclaimed when there is no customer-initiated activity or contact for a period of three to five years. The specific period is based on the escheatment laws of each state.

Who can not open a bank account?

The primary reasons people can't open a bank account are negative items on a ChexSystems or Early Warning Services report, errors on the reports or bad credit.

Both CDs and money market accounts are safe investments. They typically include FDIC insurance and don't involve the purchase of securities that may fluctuate in value. The only situation in which your investment could be at risk is if the financial institution at which you open the account declares bankruptcy.

Easier budgeting: Having separate accounts for different expenses can simplify managing your money and ensure you're covering all your financial bases. Building a savings pot: A secondary account can be earmarked for savings. Although, an easy access or regular saver account might be a more interest-friendly option.

Key Findings. An estimated 4.5 percent of U.S. households (approximately 5.9 million) were “unbanked” in 2021, meaning that no one in the household had a checking or savings account at a bank or credit union. The unbanked rate in 2021—4.5 percent—was the lowest since the survey began in 2009.

Underbanked households often rely on cash and alternative financial services, as opposed to credit cards and traditional loans, to fund purchases and manage their finances. Many underbanked households lack access to affordable banking and financial services.